[ad_1]

Getty Images

Getty ImagesThe cost of living is always important to our finances but this month’s has a particular extra impact for millions of people.

The September inflation figure, showing the rates at which prices increase, will affect how much benefits and the state pension will rise as well as influencing interest rates and the prices in shops.

It also comes just two weeks before this government’s first Budget, with the chancellor warning there will be “difficult decisions” on welfare as well as tax and spending.

Here are some of the ways in which it will directly affect you and your money.

Universal credit and other benefits

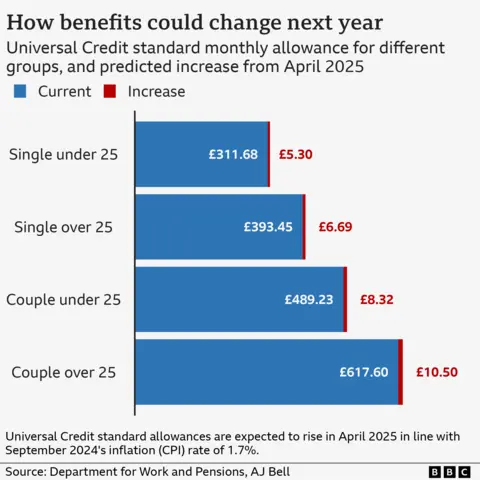

Typically, September’s Consumer Prices Index (CPI) measure of inflation, which this time is 1.7%, is the benchmark for raising benefits the following April.

The amount paid in some benefits should, by law, rise at least at the same rate as prices.

That includes all the main disability benefits, such as personal independence payment, attendance allowance and disability living allowance, as well as carer’s allowance.

Universal credit, the most common benefit which is claimed by seven million people, is among other benefits also expected to rise in line with inflation, but that is a decision for ministers.

It means that the standard allowance of universal credit, for a single person aged under 25, is expected go up by £5.30 a month to about £317.

For a couple aged over 25, the rise is likely to be £10.50 to £628 a month, according to investment platform AJ Bell.

The total amount received in universal credit depends significantly on your circumstances, such as earnings, children, or disabilities. Adding 1.7% to your current benefit amount should give a fairly accurate estimate of what you will receive in April.

About 58% of universal credit claimants are women, and 38% of the total are working.

Someone receiving attendance allowance, or the highest rate of personal independence payment, will see an increase of about £1.85 a week in April.

The increase in benefits is less than the 6.7% rise last April, which reflected the higher cost of living then.

Why the benefit rise could have been higher

September’s inflation figure was lower than expected, which means the increase in benefits is set to be relatively small.

Next month, a rise in energy bills, which took effect at the start of this month, is expected to push the inflation rate back up again – too late for the link to benefits.

The government, specifically the work and pensions secretary (no doubt working very closely with the chancellor), can decide to set a higher rate of increase for benefits. Charities would welcome such a move, but it would be extremely unlikely.

Bigger increase for the state pension

The rise in the state pension in April is governed not only by inflation, but by what is known as the triple lock.

Under that arrangement, the state pension goes up each year by either 2.5%, inflation, or earnings growth – whichever is the highest figure.

This time around, the latest data has confirmed the highest is earnings growth – at 4.1%. This is expected to mean:

- The full, new flat-rate state pension (for those who reached state pension age after April 2016) is expected to increase to £230.30 a week. That will take it to £11,975 a year, a rise of £473 compared with now

- The full, old basic state pension (for those who reached state pension age before April 2016) is expected to go up to £176.45 a week. That will take it to £9,175 a year, a rise of £361 compared with now.

It is worth noting that millions of pensioners will lose their winter fuel payment, worth up to £300, as a result of a government cut.

Interest and mortgage rate cuts more likely

Getty Images

Getty ImagesAs inflation is now below the Bank of England’s 2% target, it paves the way for further interest rate cuts.

That would make borrowing money less expensive, but could mean lower returns for savers.

Analysts say there is now a greater likelihood of an interest rate cut by the Bank in December, after a widely expected reduction from the current level of 5% in November.

That could give mortgage lenders more confidence to reduce the interest they charge on new fixed-rate home loans.

Many people face higher monthly repayments, as rates are higher than many were accustomed to for a decade.

Separate official figures show that people who are renting a home are paying 8.4% more than a year ago – displaying the continued financial squeeze on tenants.

It would be hoped that lower mortgage rates could ease some pressure on landlords and, in turn, limit rent rises for tenants.

Implications for the Budget

There remains some nervousness among borrowers and consumers in general about what will happen in the Budget, announced by Chancellor Rachel Reeves on 30 October.

Government sources have told the BBC that she is looking to make tax rises and spending cuts to the value of £40bn.

Lower inflation can help or hinder the government.

It means that the Treasury may be left with a slightly lower than expected benefits bill.

However, lower inflation and wage rises could drag fewer people into higher rates of tax, even though the thresholds have been frozen.

This means the government could also gather less in tax as a result.

[ad_2]

Source link